In the VC world, deals rarely move in straight lines. A founder you pass on today might be a perfect fit a year from now. An intro that goes quiet can resurface after one update email. A “not yet” can quietly turn into a missed opportunity if no one remembers why it mattered.

That’s why deal flow in VC is less about volume and more about continuity. It’s the ability to track conversations over long timelines, keep relationship context intact, and know exactly when to re-engage.

This guide focuses on how venture teams actually manage deal flow in practice without relying on memory, scattered notes, or one partner’s inbox.

What is Deal Flow in Venture Capital?

In venture capital, deal flow is the set of founder relationships and opportunities a fund engages with over time.

It includes:

Inbound pitches and warm introductions

Ongoing conversations with founders who aren’t ready yet

Repeat founders raising new rounds

Companies re-emerging after hitting milestones

Unlike sales pipelines, VC deal flow doesn’t move through fixed stages. Conversations pause, restart, and evolve. A “no” today often means “not now.”

Managing deal flow well means keeping track of:

Who introduced the founder, and why did it matter?

What was the fund’s original interest or hesitation?

When should the conversation be revisited?

Which partner or team member owns the relationship, whether that context lives in a shared CRM or an internal system?

When this context is preserved, funds make better decisions and miss fewer high-quality opportunities simply because time passed. For most funds, this context now lives inside a deal flow CRM, rather than scattered across inboxes, spreadsheets, and individual partner notes.

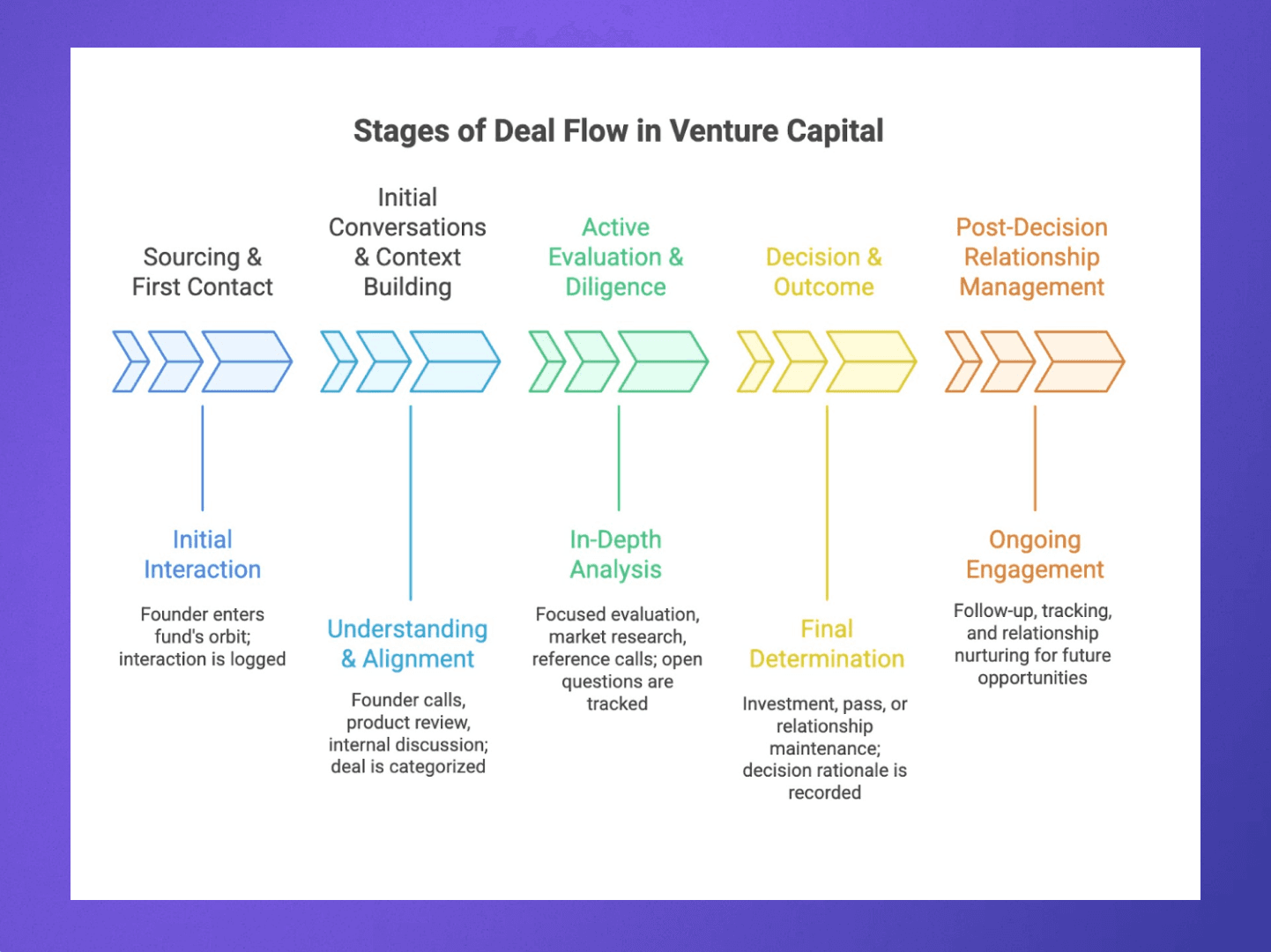

Stages of Deal Flow in Venture Capital

Below is a way to think about deal flow stages that you can actually use:

1. Sourcing & First Contact

This stage begins the moment a founder enters the fund’s orbit. That could be a warm intro, an inbound pitch, a conference meeting, or a follow-up from a past conversation.

At this point, the goal isn’t evaluation, it’s capture.

What matters early:

Who introduced the founder (and how strong that relationship is)

Why has this company surfaced now

Which partner or team member should own the conversation

Many funds lose opportunities here by relying on inboxes or memory. If the first interaction isn’t logged with basic context, it becomes hard to reconstruct later, especially when the same founder comes back six months down the line.

A good rule of thumb: if the founder took time to reach out, the fund should take time to record the interaction.

2. Initial Conversations & Context Building

Once a call happens, the deal moves from “incoming” to “understood.” This is where most of the long-term value is created, even if no investment happens right away.

This stage usually includes:

One or two founder calls

A quick look at the product, market, and trajectory

Internal alignment on whether this is a near-term or long-term opportunity

What’s important here isn’t just notes from the call, but why the fund reacted the way it did.

Did the team like the founder but not the timing? Was the market interesting but too early? Did something feel off that should be remembered later?

This is also where many deals quietly stall. Without a clear outcome, conversations end with “let’s stay in touch,” and nothing triggers the next step.

A simple way to keep momentum is to decide whether the deal is active, paused, or passed. If paused, set a reason and a revisit condition (milestone, time, or update)

3. Active Evaluation & Diligence

Deals that move forward enter a more focused phase. Fewer opportunities make it here, and that’s intentional.

Conversations move beyond introductions and into substance. This is where partners spend time on the product, the market, and how the company is actually operating. Internal discussions pick up, and preparation for partner meetings begins. Reference calls and customer conversations often happen here as well.

Unlike earlier stages, evaluation is usually time-bound. Either the deal progresses toward a decision, or it doesn’t.

At this point, clarity matters more than speed. Teams benefit from:

Clear internal ownership of the deal

A rough decision timeline, even if it shifts

A shared view of what still needs to be answered

Deals tend to slow down when no one is sure what’s left to evaluate. Writing down open questions helps prevent unnecessary back-and-forth and keeps the process moving.

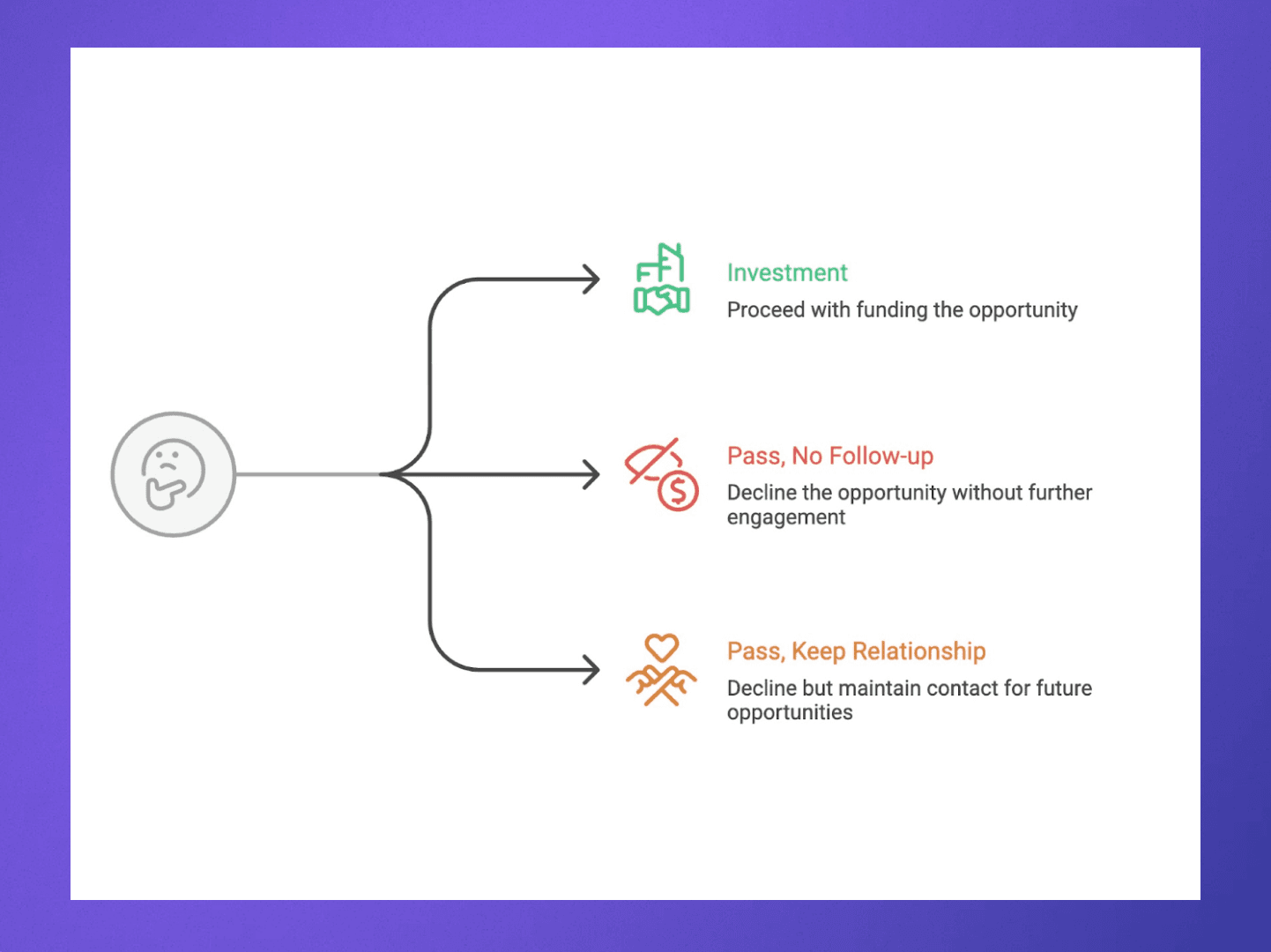

4. Decision & Outcome

Every deal eventually reaches a decision, even if it doesn’t feel like one.

Outcomes typically fall into a few buckets:

Investment

Pass, with no follow-up

Pass, but keep the relationship warm

This stage is often under-documented. Funds move on quickly after a pass, and valuable context gets lost.

It’s worth recording:

The real reason for the decision

Who should maintain the relationship, if anyone

Whether this is a hard no or a “not now”

Founders remember how funds handle this stage. A clear, respectful close builds long-term goodwill and increases the chance of seeing strong opportunities again.

5. Post-Decision Relationship Management

For VCs, deal flow doesn’t end at the decision.

Strong funds treat this stage as part of the system:

Following up with founders who were close

Tracking companies that should be revisited

Maintaining relationships that might matter later

Many great investments come from conversations that didn’t convert the first time. What separates top funds is their ability to resurface the right relationships at the right moment.

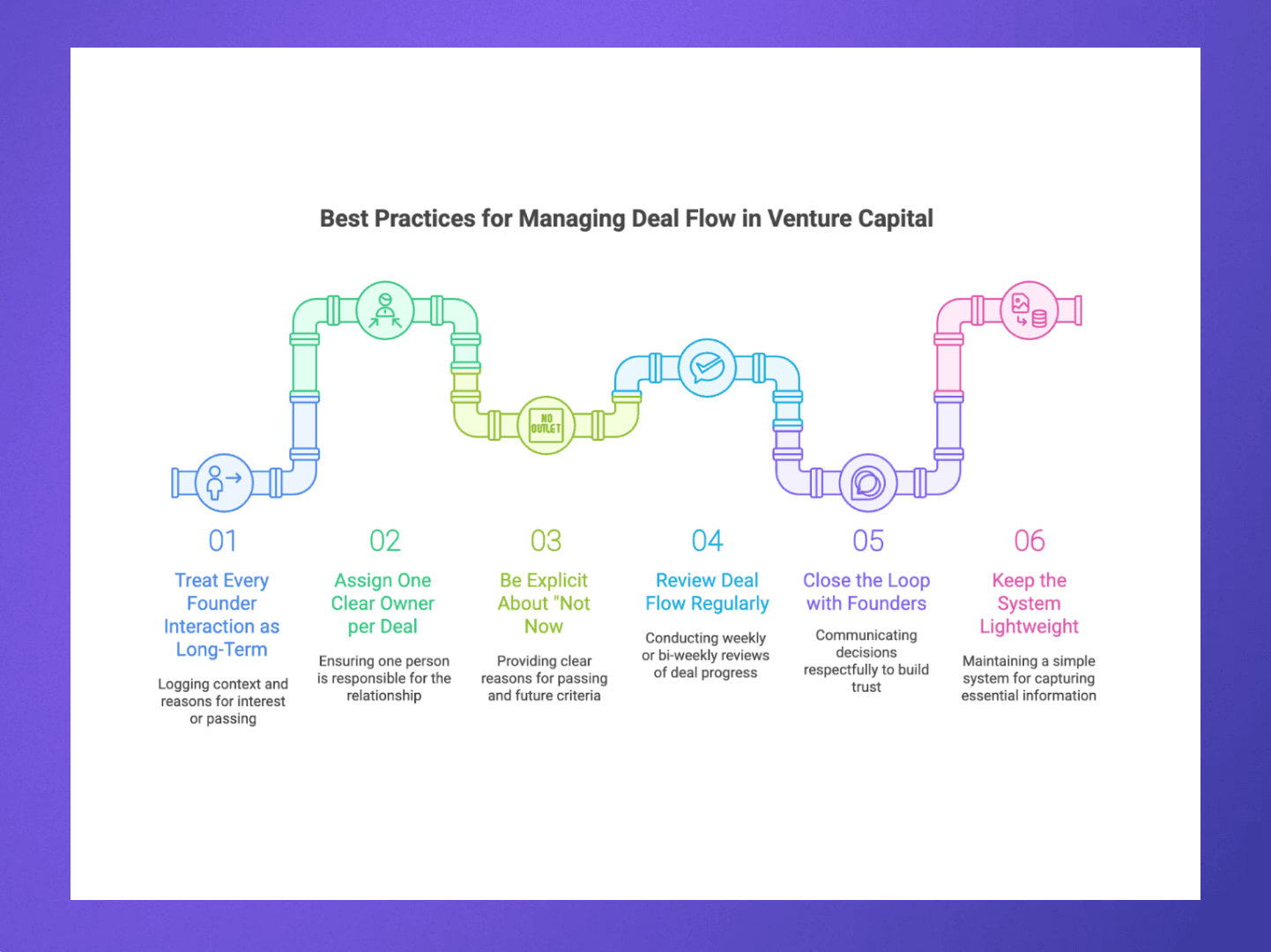

Best Practices for Managing Deal Flow in Venture Capital

Good deal flow management in VC is less about tools and more about habits. The best funds tend to do a few simple things consistently, even as deal volume grows. Those habits are much easier to maintain when they’re supported by a well-structured deal flow CRM that reflects how venture decisions actually happen.

1. Treat Every Founder Interaction as Long-Term

Most investments don’t happen on the first conversation. Logging context, reasons for interest, and reasons for passing make future re-engagement easier and more thoughtful. This pays off when founders raise again or hit the milestones they were waiting for.

2. Assign One Clear Owner Per Deal

Even when multiple partners are involved, one person should own the relationship and the next step. Shared ownership often means no ownership, and deals lose momentum quietly.

3. Be Explicit About “Not Now.”

A soft pass without a reason is a dead end. Strong teams write down why the timing wasn’t right and what would change that. These turns pass into potential future opportunities instead of closed doors.

4. Review Deal Flow Regularly, Not Reactively

Weekly or bi-weekly reviews work best when they focus on movement, not volume. Which deals have progressed? Which stalled? Which should be closed out? This keeps attention on outcomes rather than activity.

5. Close the Loop With Founders

Clear, respectful communication after decisions builds trust and reputation. Funds that handle this well see more high-quality inbound over time, even from deals they didn’t do.

6. Keep the System Lightweight

If updating deal flow feels like work, it won’t happen. The best systems capture just enough information to preserve memory and support decisions without slowing anyone down.

These practices don’t require more meetings or more process. They create clarity, which is what ultimately helps venture teams make better decisions over longer timelines.

Rings AI Helps You Manage Deal Flow Data Without Drowning in Notes

For most VC firms, deal flow problems don’t come from a lack of opportunity. They come from a fragmented context. Relationships spread across inboxes, notes disconnected from people, and decisions that are hard to revisit months later.

This is where a purpose-built venture CRM like Rings AI makes a real difference.

Rings AI is designed around how venture and private equity teams actually work. It brings relationship data, deal context, activity history, and market intelligence into one place. It helps you:

Surface warm paths into companies through shared connections

View current market and company data alongside private deal context

Track deals and pipelines in a way that fits long, non-linear VC processes

Protect sensitive investor and deal information with strong privacy controls

Maintain clear ownership and visibility across partners and team members

Capture emails, meetings, and activity automatically, without manual logging

Keep notes and files tied directly to the people, companies, and deals they relate to

See and use its full network by mapping relationships across partners, LPs, founders, and advisors

Want to see how Rings AI fits into a real VC workflow? Book a demo here and see how venture teams use it to manage deal flow without adding overhead.