Deal sourcing in private equity is a long-running, relationship-driven process. Opportunities surface through bankers, founders, executives, and existing networks over extended periods of time. The challenge isn’t finding deals once. It’s maintaining awareness of who you know, where conversations stand, and which relationships are worth revisiting as conditions change.

Traditional software tools struggle to support this reality. Sourcing activity gets split across inboxes, spreadsheets, and disconnected CRM records. Relationship history is fragmented. Prior outreach and context are hard to reconstruct. As a result, sourcing efforts depend heavily on individual memory instead of shared understanding across the firm.

Rings AI approaches deal sourcing differently. It connects sourcing activity to relationships, preserves context over time, and gives teams visibility into who knows whom and how those connections have evolved. Instead of starting from scratch each time, Rings AI helps private equity teams source deals from a position of context and continuity.

Book a demo to see how deal sourcing works in Rings AI for private equity teams.

Deal Sourcing in Private Equity

Deal sourcing in private equity is an ongoing process built on relationships, not transactions.

Opportunities emerge through long-standing networks, intermediaries, and prior conversations that evolve over time. Effective sourcing depends on knowing who to engage, when to re-engage, and how relationships have developed across past interactions.

Strong deal sourcing creates continuity across the firm. It helps teams coordinate outreach, avoid duplicated effort, and prioritize the most relevant opportunities. Without shared context, sourcing becomes fragmented and overly dependent on individual memory rather than a repeatable firm-wide approach.

Where Traditional Deal Sourcing Software Falls Short

Traditional deal sourcing tools are built to log activity, not preserve context. In private equity, this creates gaps between relationships, past conversations, and current sourcing decisions.

Sourcing activity is disconnected from the relationship history - Most tools track outreach events but fail to show how relationships have evolved over time. This makes it difficult to know whether a conversation is new, stalled, or simply resurfacing.

Firm-wide networks are invisible - Deal sourcing often depends on who knows whom across partners, advisors, and portfolio executives. Traditional software isolates contacts by owner, hiding collective network strength.

Past sourcing efforts are hard to reconstruct - Previous conversations, soft passes, and early-stage outreach are scattered across inboxes and notes. When an opportunity comes back, teams lack clear context on what was already discussed and why it stopped.

Inbound opportunities lack continuity - Banker or founder inbound often arrives without a historical context attached. Teams evaluate each opportunity in isolation, even when the firm has prior exposure to the company or people involved.

Sourcing relies too heavily on individual memory - When sourcing knowledge lives with individuals instead of the firm, coverage becomes inconsistent and fragile. This is especially risky as teams grow, roles change, or new funds are raised.

Rings AI - A Better Way of Sourcing Deals in Private Equity

Deal sourcing in private equity depends on long-term relationships, not one-time outreach. Opportunities surface through repeated interactions with bankers, founders, and operators over years, not weeks. The challenge is maintaining context and focus as those conversations evolve.

Most sourcing efforts break down when history is fragmented across tools and individuals. Without shared visibility into relationships and past conversations, teams miss opportunities that were already within reach.

Rings AI was built to help private equity teams source deals with continuity, shared context, and a clear view of their collective network.

Turns firm-wide relationships into an active sourcing engine

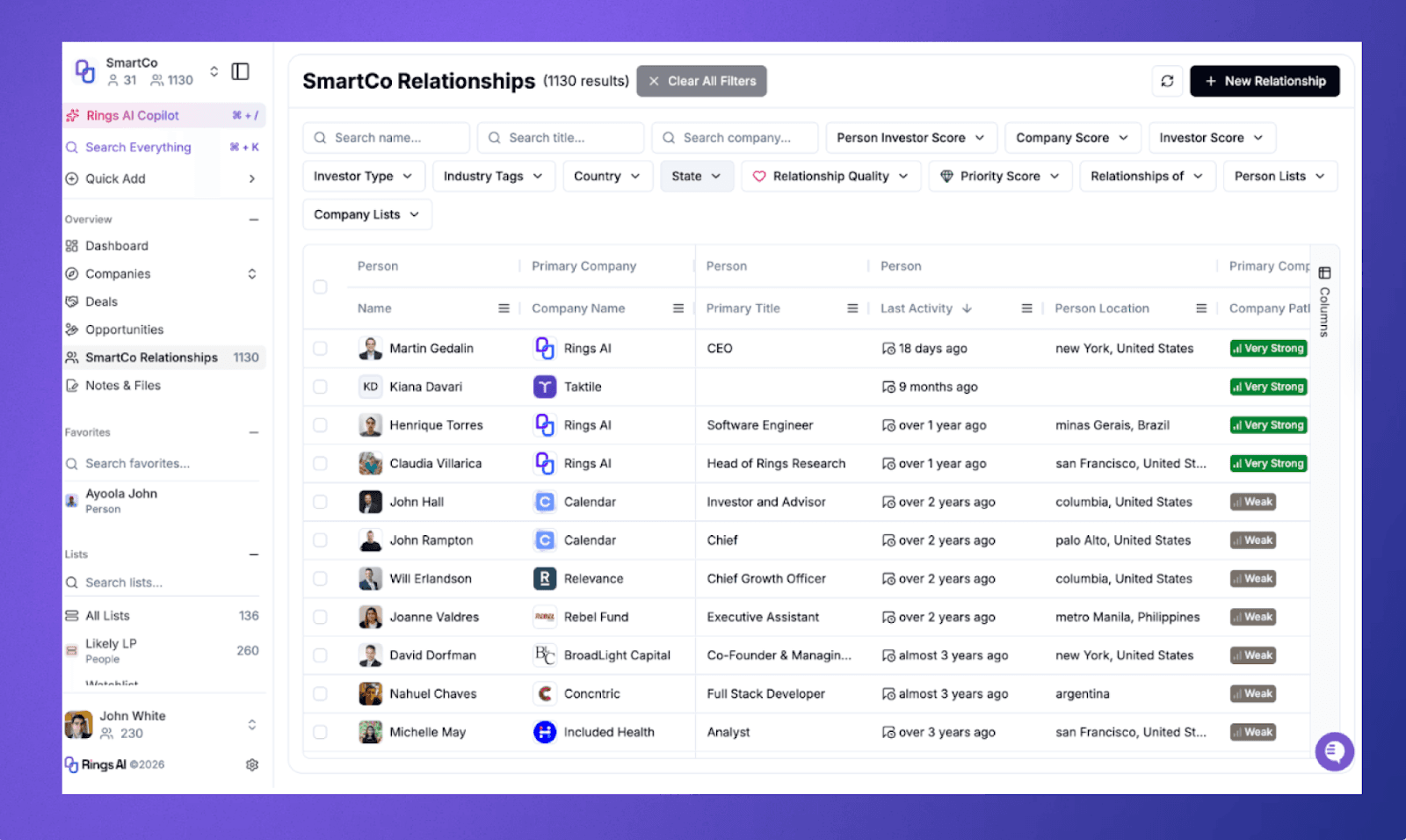

Private equity sourcing is driven by who your firm knows, not just who an individual partner knows. Rings AI maps relationships across the entire team, making it easier to identify warm paths to new opportunities.

Instead of sourcing from static lists, teams can see where real relationship strength exists and prioritize outreach accordingly. This shifts sourcing from cold discovery to informed engagement.

By grounding sourcing decisions in relationship depth, Rings AI helps firms focus time and effort where it is most likely to produce results.

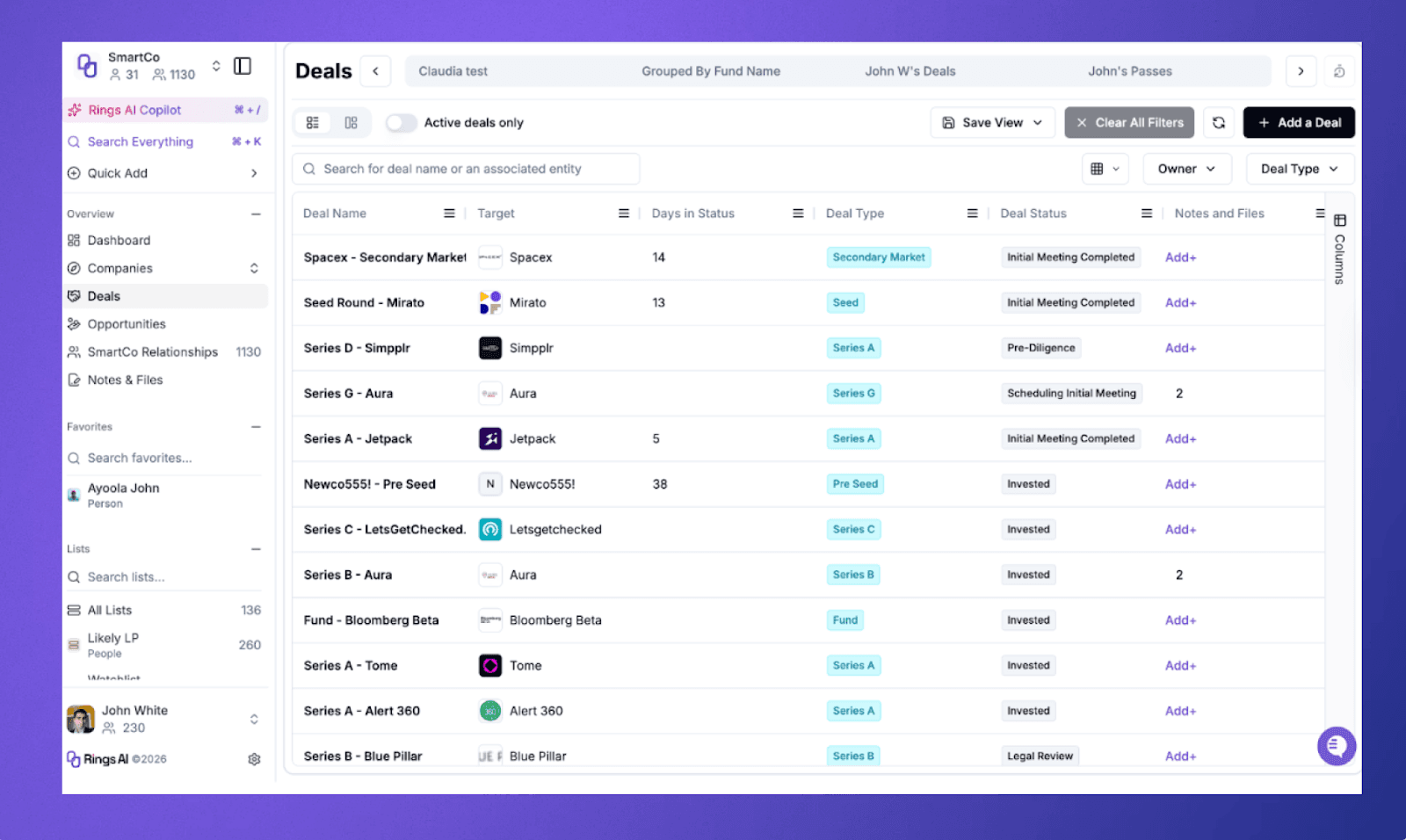

Preserves sourcing context as conversations evolve over time

Deal sourcing conversations often pause and restart as market conditions, strategies, or management teams change. Rings AI preserves prior outreach, discussions, and internal thinking so teams can re-engage without losing context.

This continuity prevents repeated conversations and missed signals. When an opportunity resurfaces, teams can quickly understand what was discussed before and why it stalled.

Maintaining sourcing history over long timelines supports better judgment and more consistent engagement across investment cycles.

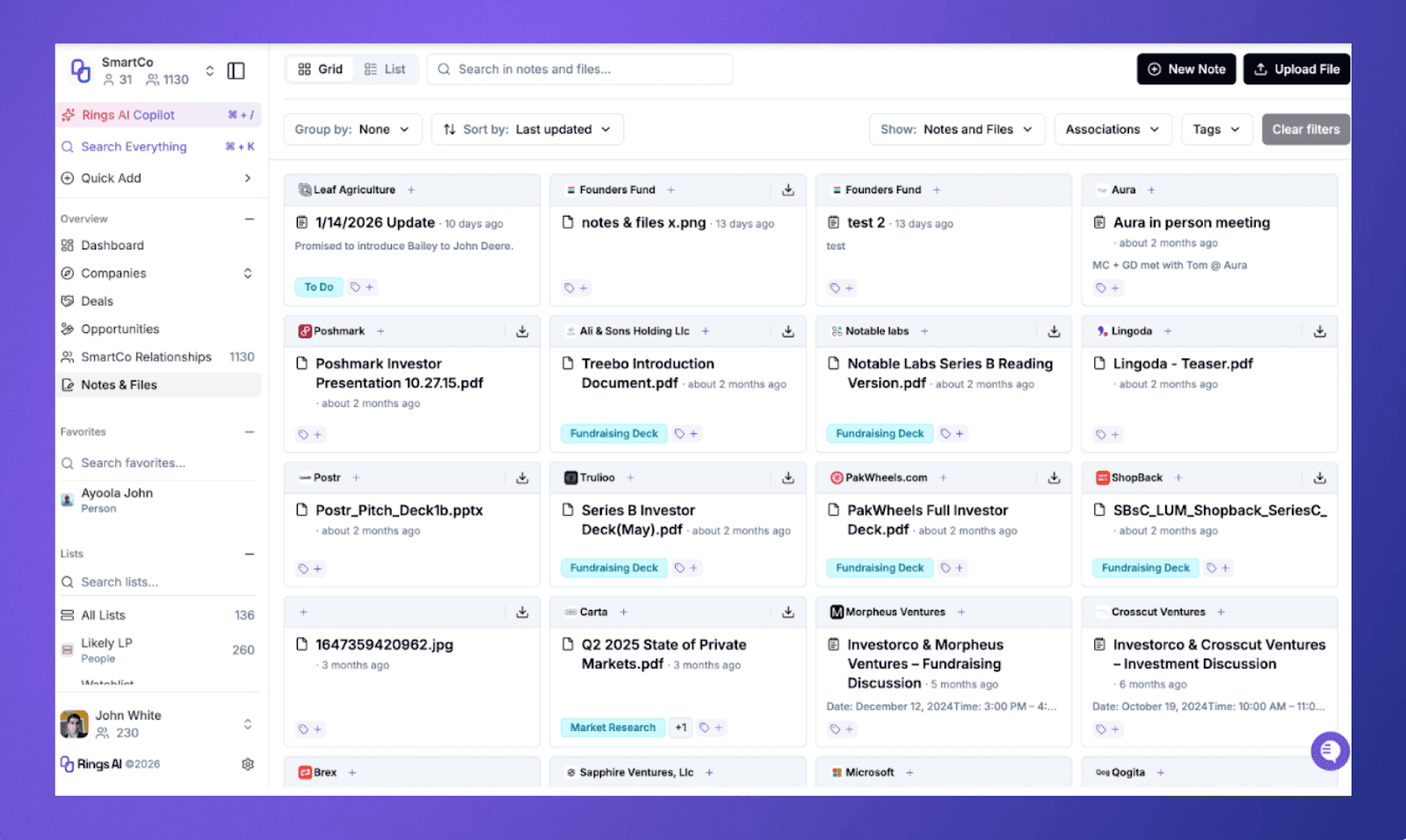

Creates shared ownership of sourcing across the firm

Sourcing should not depend on individual memory or personal tracking systems. Rings AI provides shared visibility into sourcing activity so teams can coordinate outreach and avoid duplicated effort.

As team members change roles or funds evolve, sourcing knowledge remains accessible to the firm. This reduces risk and ensures continuity even as responsibilities shift.

By centralizing sourcing context, Rings AI helps private equity teams operate with alignment and consistency over time.

Make Deal Sourcing a Repeatable Advantage With Rings AI

When deal sourcing relies on individual memory and disconnected tools, coverage becomes inconsistent, and opportunities slip through the cracks. Firms spend time rediscovering relationships they already have, instead of building on what’s been established.

Rings AI gives private equity teams a single system to manage sourcing with context. By connecting relationships, past conversations, and firm-wide activity, Rings AI helps teams source deals with clarity and coordination, not guesswork.

See how private equity teams use Rings AI to source deals more effectively. Book a demo.