If you are looking to fund your business or just learning about the finance world, you will eventually come across two types of investors that sound similar but work in very different ways. These are Private Equity (PE) and Venture Capital (VC).

They're often grouped together, yet they focus on different stages of a company and take different risks. Understanding these differences helps you choose the type of partner that supports your long-term plans.

In this blog, we will walk through what PE and VC actually do, how they invest, and examples that show where each one fits.

What is Private Equity

Private Equity refers to investors who buy ownership in companies that are already operating, already generating revenue, and usually have a proven business model. They are not looking for ideas or early experiments. They focus on businesses that have a track record but need capital, structure, or operational improvements to grow further.

A Private Equity firm typically purchases a significant stake, often a majority. This gives them the ability to influence how the company is run. Their goal is straightforward: increase the company’s value over a few years, then exit through a sale or IPO.

To do this, they improve margins, strengthen management, expand into new markets, or streamline operations. They are more hands-on because the companies they buy are expected to produce stable cash flow and can support stronger oversight.

Private Equity is best suited for companies that are stable, have clear financials, and are ready to be taken to their next stage of growth.

What is Venture Capital

Venture Capital refers to investors who fund companies that have high growth potential, whether they are just starting out or already scaling fast. VC can come in at the seed stage, Series A, or even later rounds like Series C or D, as long as the business is still in expansion mode and not yet operating like a mature, steady-state company.

Unlike Private Equity, VCs usually take a minority stake. They invest to help a company grow quickly, hire, expand into new markets, or build products faster. They focus less on current profitability and more on the size of the opportunity and the pace of growth. Their returns depend on a few big winners rather than every company succeeding.

Venture Capital works best for companies that are growing quickly and need funding to push into their next phase, regardless of whether they are at seed, Series A, or later stages.

Private Equity vs. Venture Capital

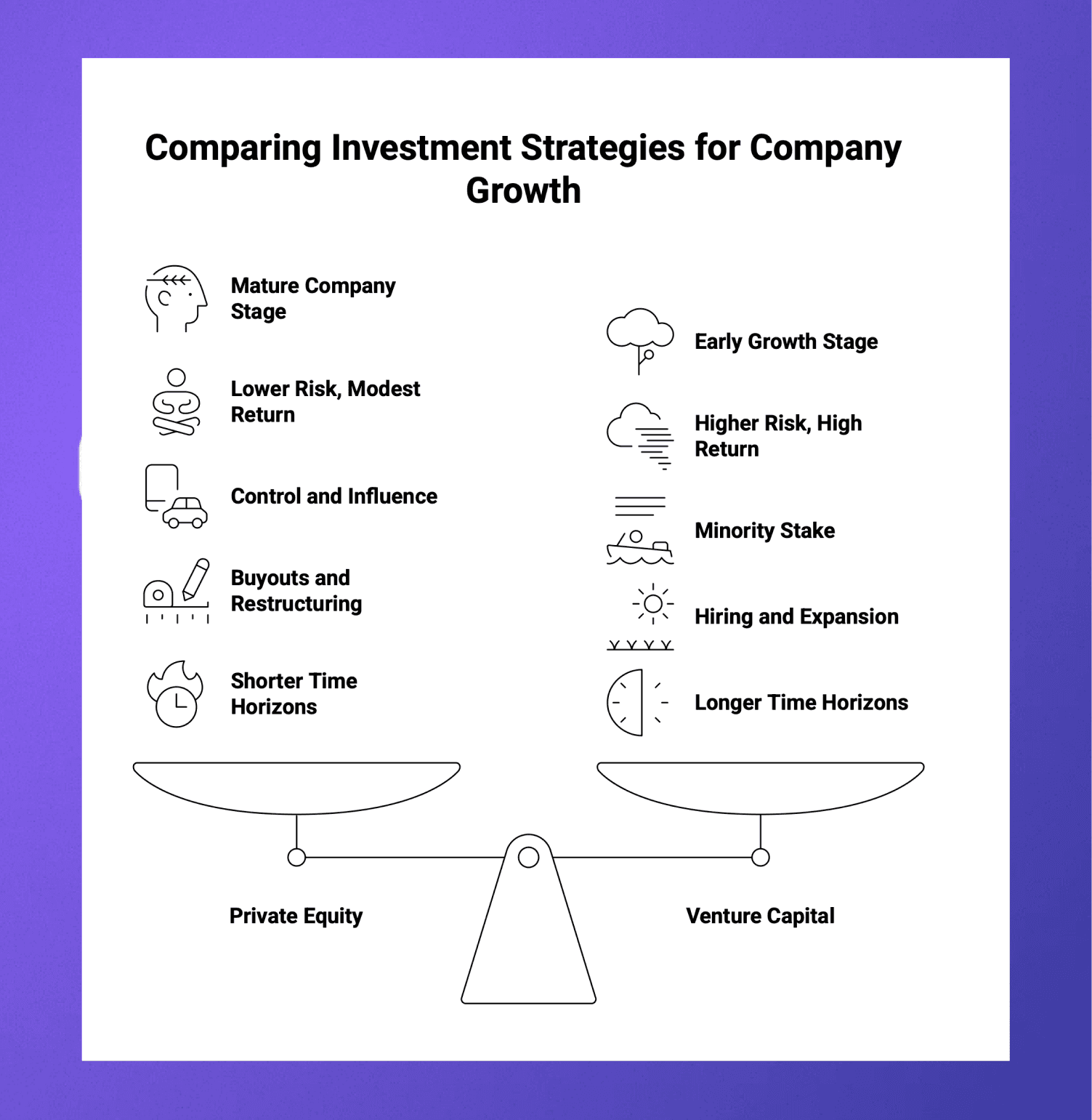

Private Equity and Venture Capital both invest money into companies, but they do it for entirely different reasons and at different points in a company’s journey.

Stage of the company

Private Equity usually enters when a company has already proven itself. It has revenue, customers, predictable cash flow, and a product that works. The company may not be growing fast anymore, or it may need better systems to scale.

Venture Capital enters when the company is still moving toward its peak. It may be pre-profit, mid-growth, or even early stage. The common thread is that the company still has significant room to expand.

Risk and return profile

PE deals involve lower uncertainty because the company’s performance is visible in the financial statements. The upside is more modest but more reliable.

VC deals involve higher uncertainty because growth is not guaranteed. The upside can be very high, which is why VCs are comfortable with some failures.

Ownership and control

PE firms often want control or strong influence. They reshape operations, fix costs, replace leadership if needed, and implement new systems. Their value creation comes from improving the engine that already exists.

VCs usually take minority stakes. Their value creation comes from helping founders grow the engine faster, not rebuild it.

Use of money

A PE investment often funds buyouts, acquisitions, or restructuring. The money may not go directly into building a product. A VC investment usually funds hiring, product expansion, go-to-market, and geographic growth.

Time horizons

PE firms exit sooner because mature companies don’t require long development cycles.

VCs follow longer timelines since early or growth-stage companies need time to scale before reaching a point where a sale or IPO makes sense.

Here's a quick overview of how PE and VC differ from each other:

Category | Private Equity | Venture Capital |

Stage of Company | Mature, stable companies with predictable revenue | Early to growth-stage companies with expansion potential |

Risk Level | Lower risk because the business has a track record | Higher risk because the business is still growing or experimenting |

Stake Purchased | Often, the majority stake | Usually, a minority stake |

Investment Size | Larger investments, often tens or hundreds of millions | Smaller checks at the early stage, larger ones in growth rounds |

Focus | Improving operations, efficiency, and profitability | Growing fast, expanding markets, building product |

Involvement | More hands-on, may restructure teams or processes | Advisory support, hiring help, introductions, strategy guidance |

Return Model | Improve the business and exit at a higher valuation | Back multiple companies and rely on a few big winners |

Time Horizon | Usually 4 to 7 years | Varies by stage, often 7 to 10 years |

Typical Example | Buying a profitable manufacturing or services company | Funding a SaaS, fintech, consumer app, or biotech startup |

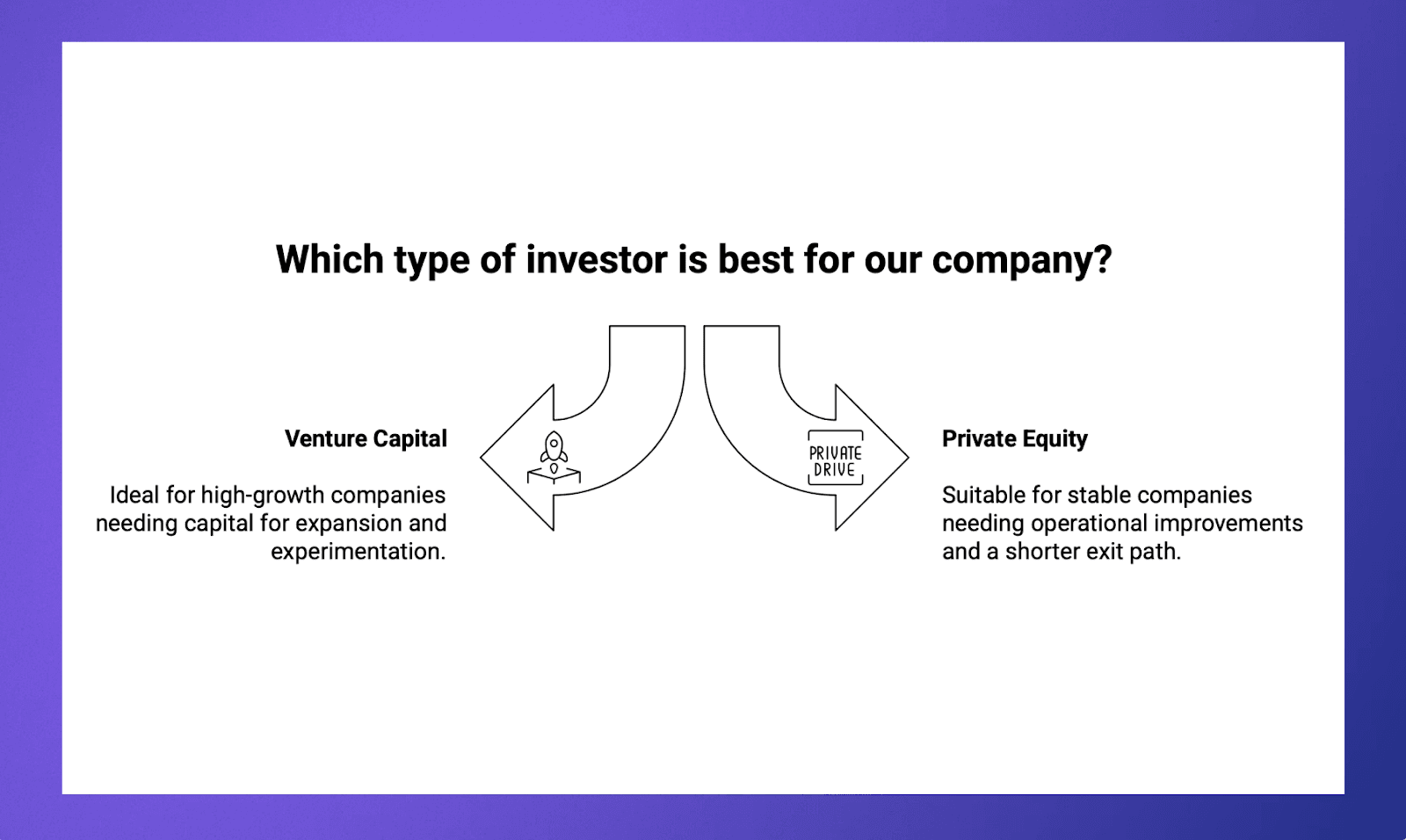

Which is the best option for your company

A simple way to choose between Private Equity and Venture Capital is to look at what your company actually needs in the next three to five years. Every business sits at a different point on the spectrum between stability and growth, and your investor type should match where you stand.

Revenue

Start by looking at how your revenue behaves. Some companies can predict next quarter’s numbers with good accuracy. Others see big swings depending on product updates, new channels, or new markets. If your business feels like it runs on momentum and opportunity, you’ll benefit from an investor who understands experimentation and fast execution. If the business feels more like a machine that needs tuning, you’ll want an investor who can improve the mechanics.

Help you need

Then think about the kind of help you need. Some teams need capital to hire, build, and expand. Some need operational depth, stronger processes, and better financial discipline. One is about speeding up. The other is about strengthening the foundation. You already know which one feels more urgent for your company.

Relationship with investor

Another useful lens is to imagine your ideal relationship with an investor. Do you want someone who advises you but lets you run the show, or someone who works closely with your leadership team and shapes key decisions? Your comfort with collaboration, structure, and shared control says a lot about the type of partner that will work well with you.

Timelines

Finally, consider your own timeline. If your company is still in a high-growth phase and you’re willing to trade time for scale, the VC path aligns well. If you want a shorter path to a clean exit or a major transition, PE fits that journey better.

When you look at these factors together, you won’t need a formula. The type of investor that fits your company becomes obvious.

Find the Right VCs or PE Firms to Help Grow Your Business

Deciding between Private Equity and Venture Capital is much easier when you have a clear view of who is in your network, which firms match your stage, and where warm introductions already exist. Most teams do not have that visibility. Their investor notes, emails, and spreadsheets are scattered, which makes the fundraising process slower than it needs to be.

Rings solves this problem by organizing all your relationships, activity, and investor intelligence in one place. It pulls data from your email, calendar, and LinkedIn to build complete profiles of the people and companies you interact with. It shows which investors are active, which portfolios match your space, and which of your contacts can open a warm introduction. Instead of guessing who to approach or when to reach out, you make decisions backed by real signals.

If you want to make your fundraising process more predictable and use your network more intentionally, Rings gives you the visibility to do that. Book a demo here to get started.