Deal tracking in private equity breaks down when context gets lost.

Conversations start early, pause, restart, and stretch across years. The same company can surface through different bankers, different funds, or different partners. Teams need to know what’s been said before, who knows whom, and why decisions were made. When that history isn’t clear, deal tracking becomes guesswork instead of shared understanding.

Traditional software tools struggle with this reality. They treat deals as linear processes that move cleanly from stage to stage. Notes get buried inside old opportunities. Relationships reset when a deal closes or stalls. Over time, important context lives in inboxes, spreadsheets, or people’s heads. Teams end up tracking motion instead of meaning.

Rings AI approaches deal tracking differently. It keeps deals, relationships, notes, and history connected over time, even as deals pause, change, or resurface. Instead of forcing private equity work into rigid workflows, Rings AI preserves continuity so teams can see the full picture at any moment and make decisions grounded in real context.

Book a demo to see how deal tracking works in Rings AI for private equity teams.

Deal Tracking in Private Equity

Deal tracking in private equity centers on maintaining context over time. Deals move through extended, non-linear cycles, often resurfacing after long periods of inactivity.

Teams need to understand not just where a deal stands today, but how it has evolved, who has been involved, and what conclusions were reached along the way.

Effective deal tracking supports informed decision-making across the firm. It helps teams retain institutional knowledge, coordinate across partners and funds, and approach recurring opportunities with clarity. Without this continuity, deal tracking becomes fragmented, and decisions rely too heavily on individual memory rather than shared understanding.

Where Traditional Deal Tracking Falls Short

Most deal tracking tools are built for speed and reporting, not for long-term context. In private equity, where decisions depend on history and relationships, this gap becomes obvious over time.

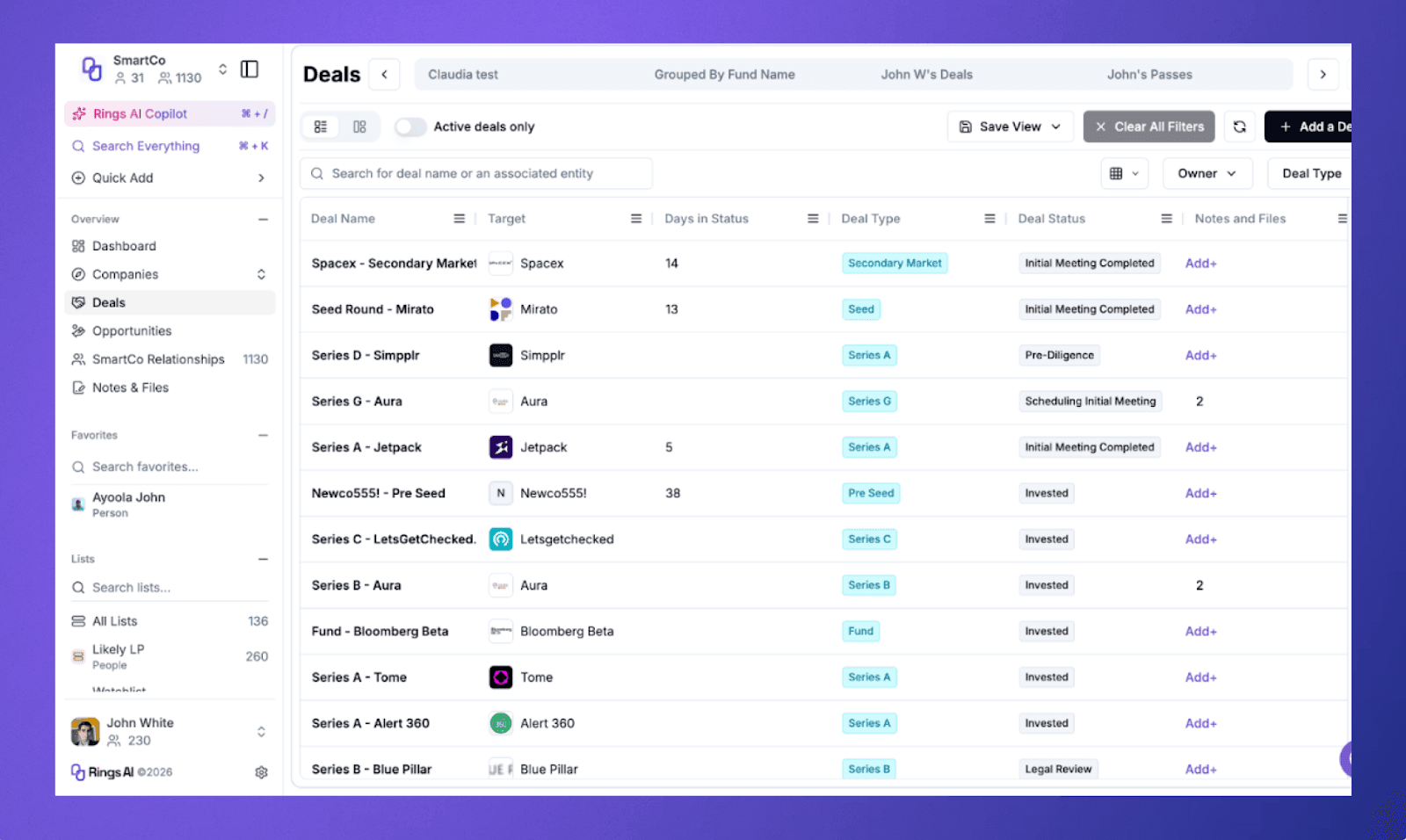

Deal stages flatten reality - Linear pipelines assume steady progress, even when deals pause, reset, or resurface years later. This makes it hard to understand the true deal beyond a label.

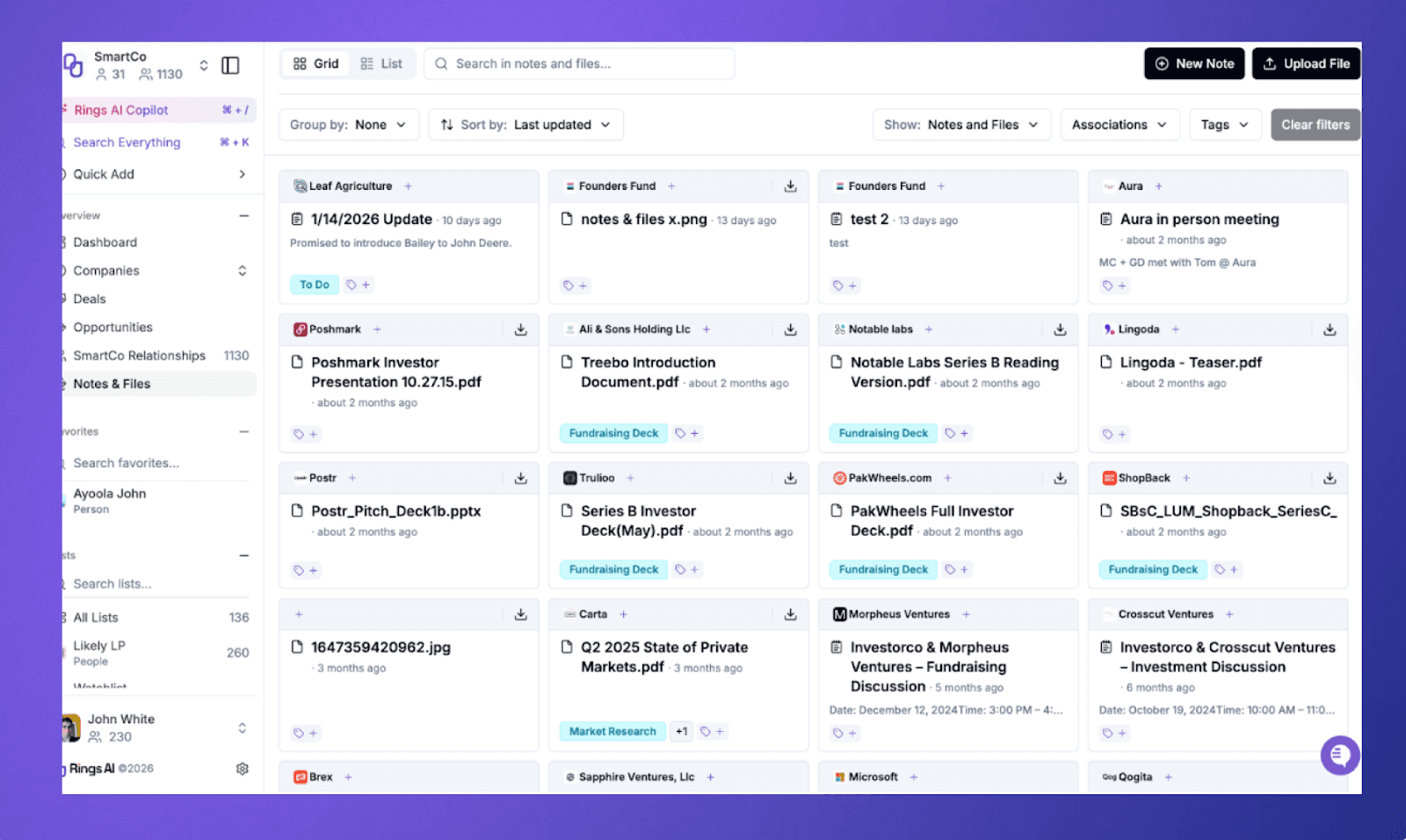

Context gets buried over time - Notes, files, and past decisions often live inside closed or inactive records. When a deal comes back, teams struggle to reconstruct what actually happened and why. This is a common source of institutional memory loss in deal-driven organizations.

Relationships are treated as secondary - Traditional tools center on the deal, not the people. Relationship history is disconnected from deal activity, even though relationships often drive whether a deal progresses at all.

Handoffs create knowledge gaps - As ownership changes across partners, associates, or funds, context degrades. Teams rely on personal recall instead of a shared system of record, increasing decision risk.

Tracking favors reporting over understanding - Many systems are optimized for summaries and updates, not for helping teams quickly understand prior conversations, signals, and reasoning. This limits their usefulness in long-running private equity workflows.

Rings AI - A Better Way to Track Deals in Private Equity

Rings AI is built to support how deal tracking actually works in private equity. It preserves context across long timelines so teams can make decisions based on shared history, not fragmented updates.

Preserves deal context across long timelines

Private equity deals often pause, reset, or return under different circumstances. What matters in those moments is not just the current status, but what was learned before. Rings AI keeps prior conversations, decisions, and signals intact as deals evolve over time.

This continuity allows teams to re-engage opportunities without reconstructing history from scattered notes or inboxes. When a deal resurfaces, context is immediately available, reducing friction and decision latency.

By treating deal history as cumulative rather than disposable, Rings AI supports the long time horizons common in private equity investing.

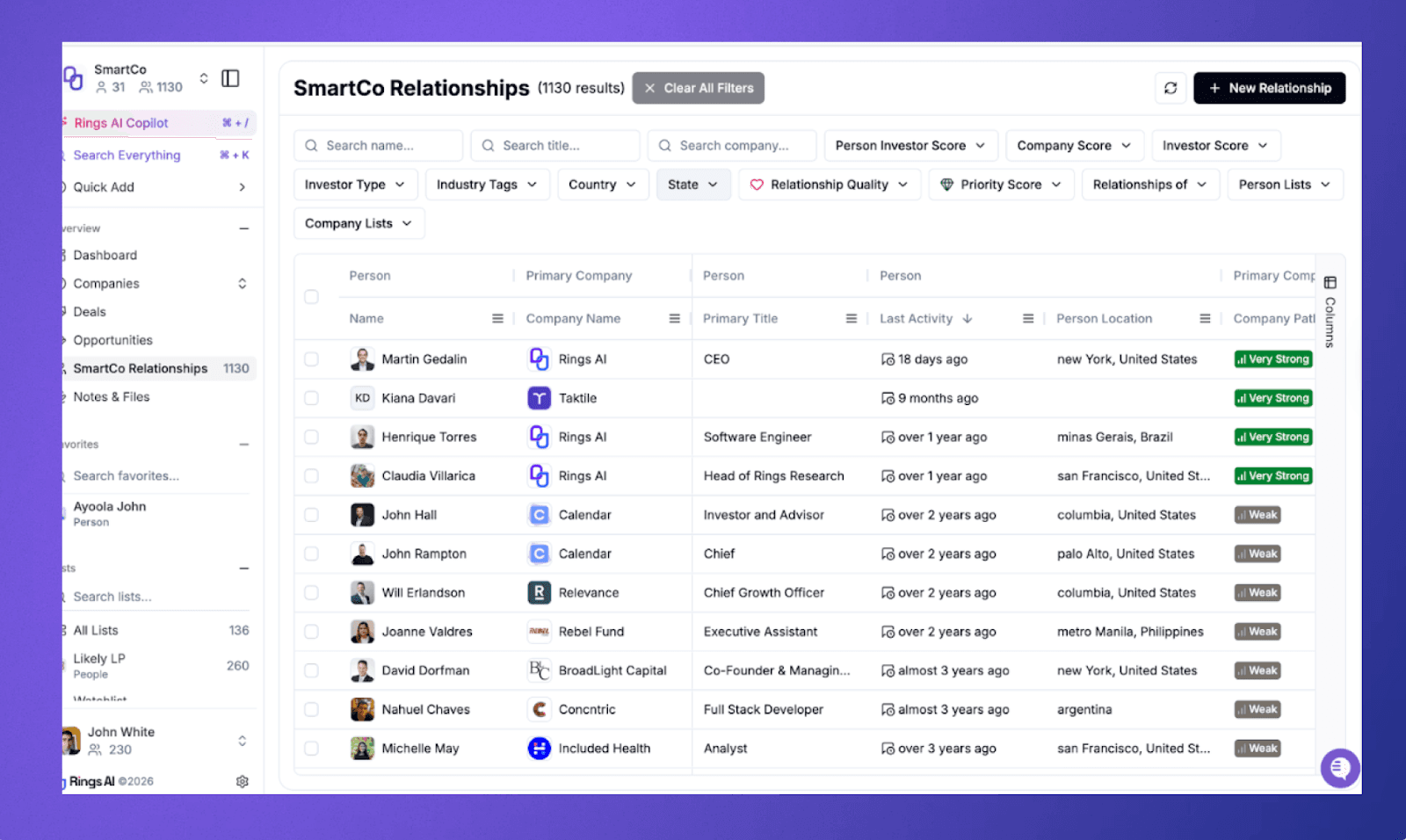

Makes relationship history actionable in deal decisions

In private equity, relationships influence access, diligence quality, and outcomes. Rings AI surfaces relationship history directly alongside deal activity, making it easier to understand who is involved and how those relationships have developed.

Instead of relying on assumptions or informal knowledge, teams can assess relationship strength based on real interaction history. This supports better prioritization and more informed outreach.

By integrating relationship context into deal tracking, Rings AI helps firms evaluate opportunities with a clearer view of interpersonal dynamics.

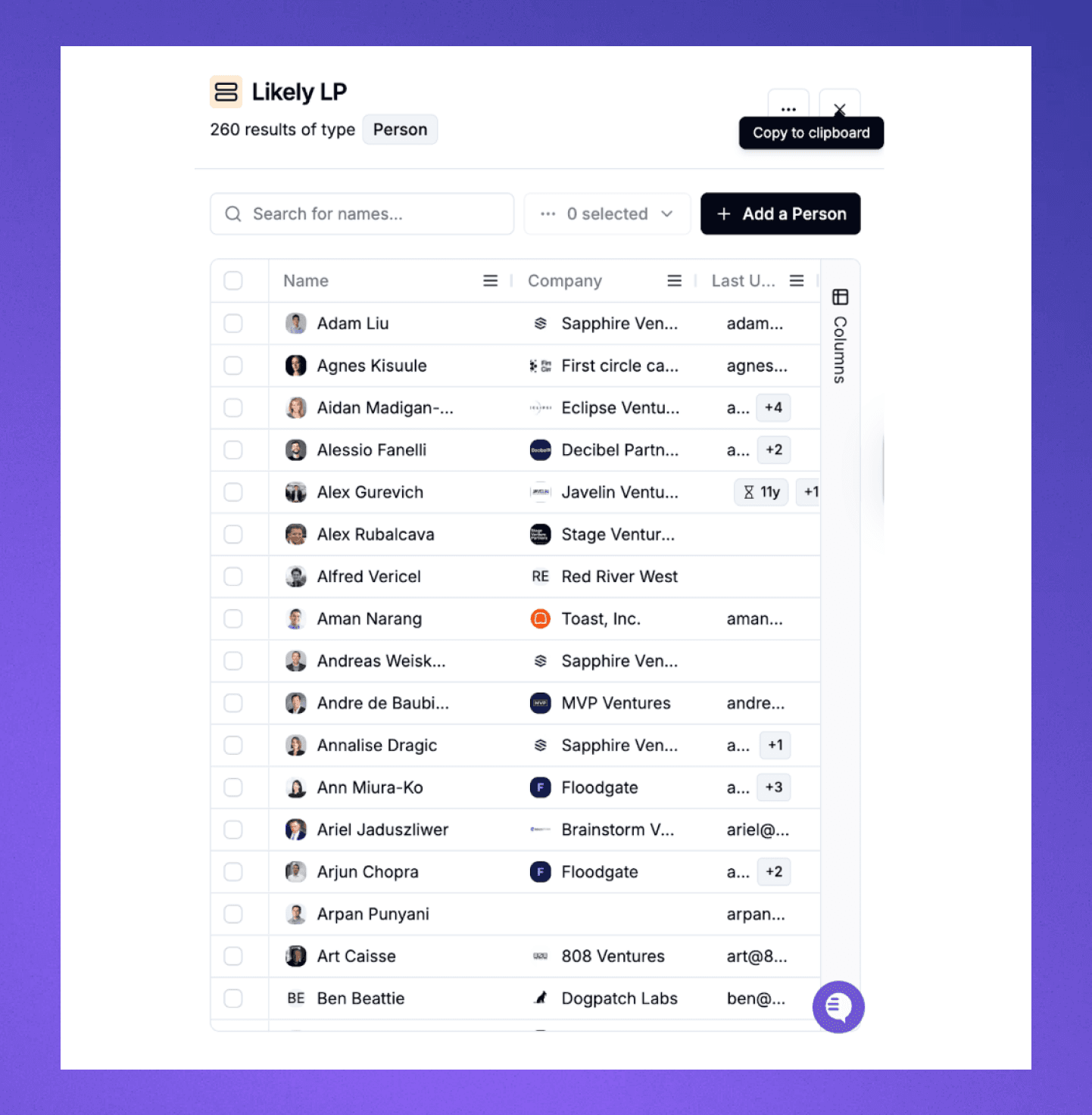

Creates shared institutional memory across the firm

Private equity teams change over time, but decisions depend on a consistent understanding. Rings AI preserves internal thinking, notes, and supporting materials beyond individual ownership or deal status.

This shared memory reduces reliance on personal recall and minimizes information loss during handoffs. New team members can quickly understand past reasoning without extensive back-and-forth.

By centralizing institutional knowledge, Rings AI helps firms maintain continuity across funds, partners, and investment cycles.

Bring Deal Tracking Back to Decision-Making With Rings AI

When deal tracking turns into status reporting, teams lose sight of what actually matters. Context gets fragmented, history fades, and decisions rely more on memory than shared understanding. Over time, this creates risk, especially in private equity, where past conversations often shape future outcomes.

Rings AI is built to keep deal tracking grounded in context. It connects deals to relationships, preserves institutional knowledge, and gives investment teams a clear view of how opportunities have evolved over time. Instead of tracking motion, Rings AI helps teams track meaning.

See how private equity teams use Rings AI to track deals with full context. Book a demo.