An LP, or Limited Partner, in private equity is an investor that commits capital to a private equity fund but does not participate in day-to-day investment decisions. LPs provide the majority of the fund’s capital, while the General Partner manages investments, operations, and execution.

In practice, LPs are institutions or individuals with long-term capital seeking exposure to private markets through professional managers. Their role is defined by contractual agreements that outline governance rights, economics, reporting, and risk exposure. This structure allows LPs to access private equity returns without directly sourcing or operating portfolio companies.

Understanding the LP role is critical because private equity is built on long-term alignment between capital providers and fund managers. The expectations, constraints, and incentives of LPs shape how funds are raised, how capital is deployed, and how relationships are managed across multiple fund cycles.

The Role of an LP in a Private Equity Fund

Limited Partners provide the capital that enables a private equity fund to operate, but they do not control investment execution. Their role is primarily financial and governance-oriented, defined by the fund’s limited partnership agreement.

LPs commit capital for a multi-year period and meet capital calls as investments are made. In return, they receive economic exposure to the fund’s performance, along with agreed reporting, transparency, and certain protective rights, without participating in day-to-day decision-making.

At a high level, LP responsibilities and expectations include:

committing capital across the life of the fund

evaluating the GP’s strategy, track record, and risk management

monitoring performance through reporting and LP communications

Common Types of Limited Partners

Private equity LPs are typically institutions or individuals with long-term capital and specific return, liquidity, and risk requirements. While their mandates differ, they share a common need for disciplined fund governance and consistent reporting.

The most common LP types include:

Pension funds, which allocate to private equity to meet long-duration liabilities and enhance returns

Endowments and foundations, which seek diversified growth to support perpetual spending needs

Sovereign wealth funds, often deploying capital strategically across regions and asset classes

Insurance companies, investing within regulatory and capital adequacy constraints

Family offices and high-net-worth individuals, with flexible mandates and longer investment horizons

These groups differ in scale, decision-making speed, and risk tolerance, which influences how private equity funds structure communication, reporting, and long-term relationships.

What Is the Difference Between GP and LP in Private Markets?

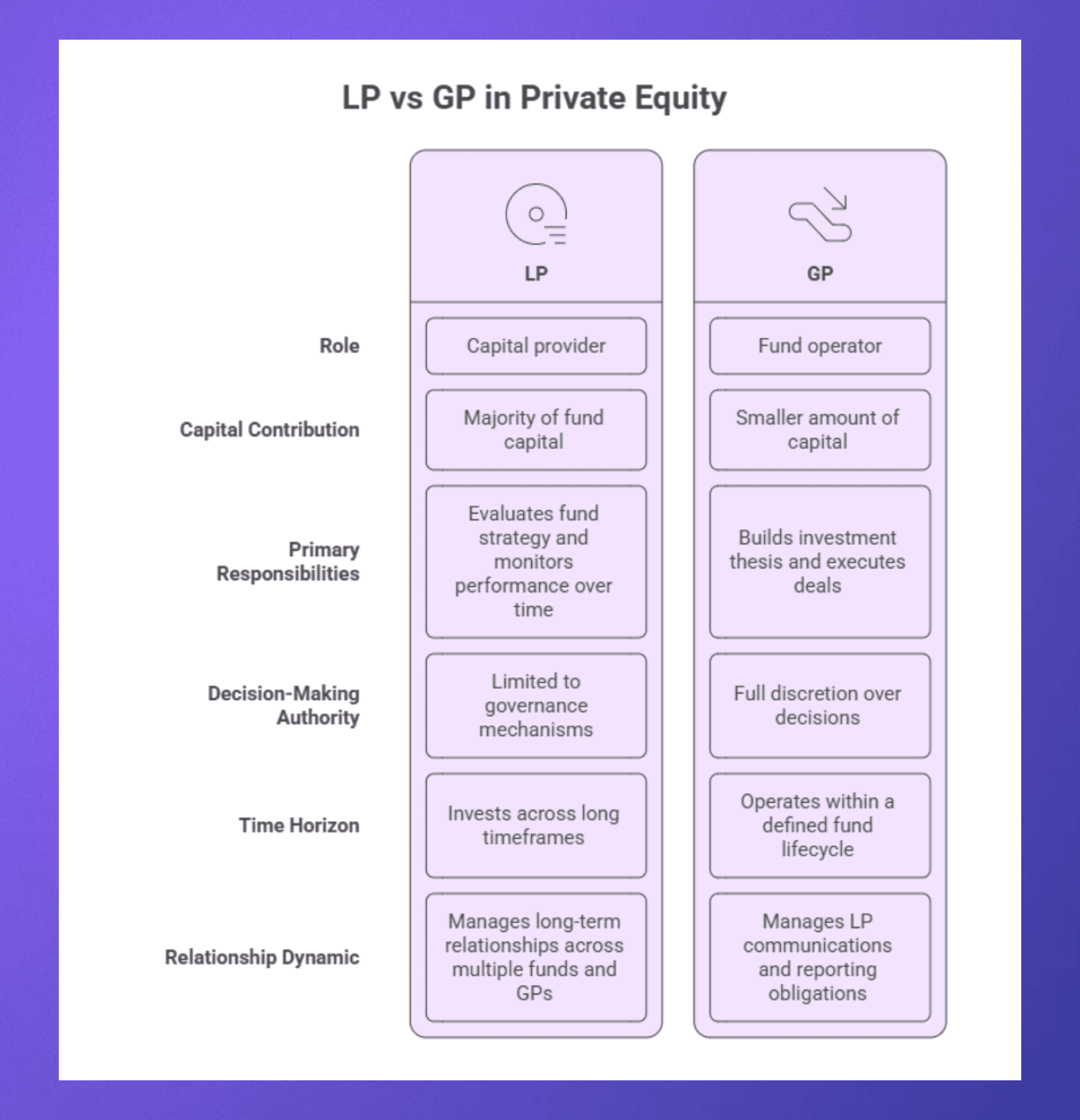

In private markets, LPs and GPs play fundamentally different roles. LPs supply capital and receive economic exposure, while GPs are responsible for strategy, sourcing, execution, and ongoing management of investments.

GPs control investment decisions, manage portfolio companies, and run the fund’s operations. In exchange, they earn management fees and performance-based compensation. LPs, by contrast, do not influence individual deals and are protected by governance rights set out in the fund agreement.

LP vs VC: Understanding the Difference

An LP is a role within a fund structure, not an investment strategy. Venture capital refers to a strategy typically executed by GPs who manage venture funds. LPs can invest in venture capital funds, private equity funds, and other private market vehicles using the same underlying LP model.

How LPs and GPs Work Together

The LP-GP relationship is structured through legal agreements and sustained through ongoing communication. Alignment is established upfront around strategy, governance, and economics, then maintained across the life of the fund.

LPs engage with GPs through formal mechanisms such as reporting, advisory committees, and annual meetings. These touchpoints allow LPs to monitor performance, understand portfolio developments, and assess risk without participating in individual investment decisions.

Over multiple fund cycles, effective collaboration depends less on control and more on trust, transparency, and consistency. Funds that communicate clearly and preserve institutional context tend to build stronger, longer-lasting LP relationships.

How LP Commitments and Capital Calls Work

When an LP invests in a private equity fund, it commits a fixed amount of capital upfront but does not transfer the full amount immediately. Instead, capital is drawn over time as investments and expenses arise.

GPs issue capital calls in line with the fund’s investment pace and contractual terms. LPs are required to fund these calls within a specified period, making cash-flow planning a core part of LP portfolio management.

At a practical level:

commitments define the LP’s maximum exposure to the fund

capital calls align cash deployment with actual investment needs

uncalled capital remains with the LP until formally requested

How Returns Work for LPs in Private Equity

LP returns are driven by the performance of the fund’s underlying investments and distributed according to a predefined waterfall. Cash flows typically include return of capital, preferred returns where applicable, and profit distributions after fees.

Economics are split between LPs and GPs through two primary components: management fees and carried interest. Fees cover fund operations, while carry aligns incentives by rewarding the GP for performance above agreed thresholds.

Key elements LPs evaluate include:

timing and predictability of distributions

fee and carry structures across the fund’s life

alignment created by the waterfall mechanics

Managing Long-Term LP Relationships With Rings AI

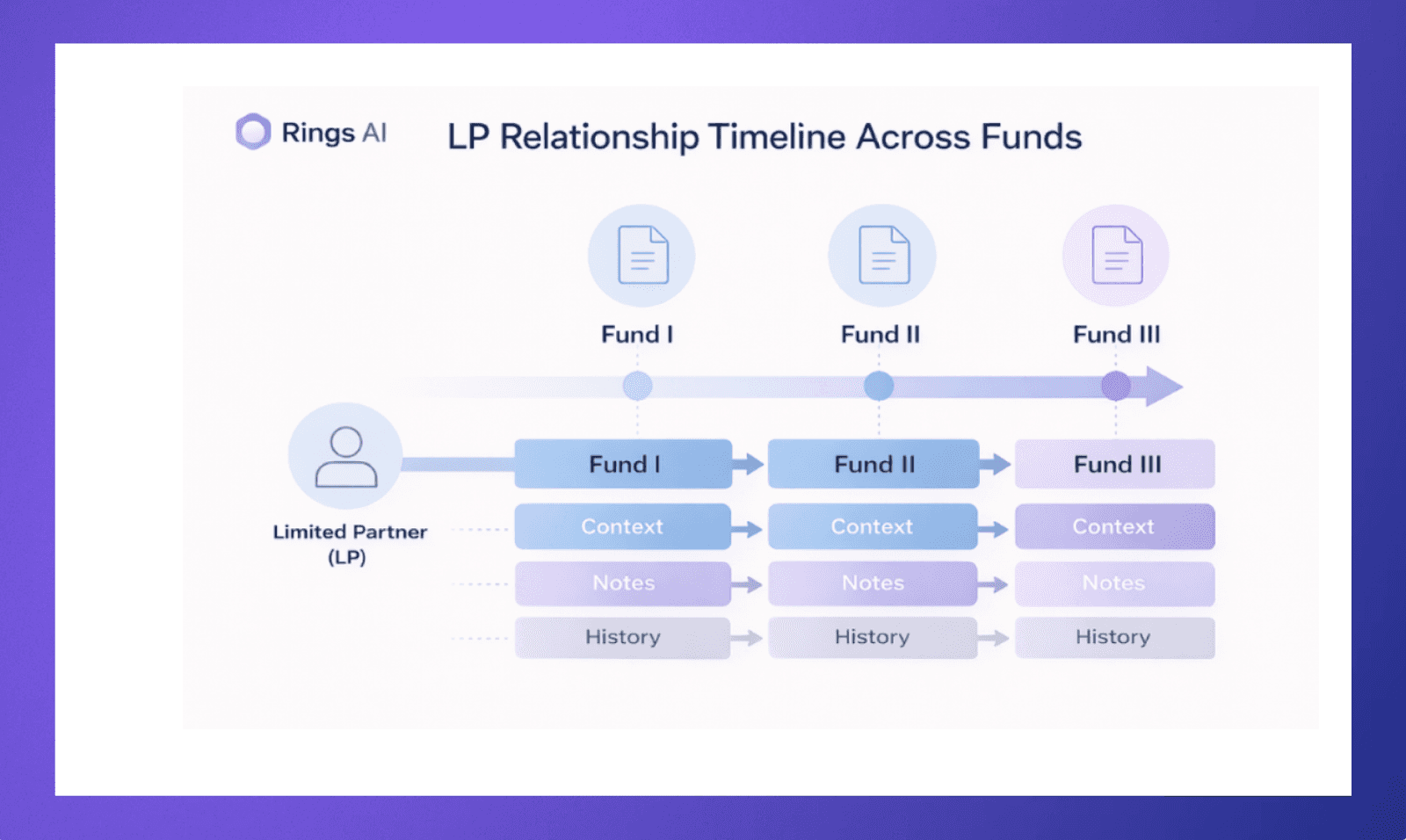

LP relationships extend across funds, market cycles, and repeated interactions. Context accumulates over time through meetings, updates, side letters, and informal conversations, making continuity as important as performance.

Rings AI is designed to help investment teams maintain that continuity. It keeps LP relationships, communication history, and internal context connected in one place, reducing reliance on individual memory as teams and funds evolve.

By preserving relationship history across fundraising cycles, Rings AI supports more consistent LP engagement and clearer institutional understanding over the long term. To see how Rings AI supports long-term LP relationship management in practice, book a demo.