Portfolio monitoring in private equity is the ongoing process of tracking, evaluating, and managing the performance, risks, and strategic progress of portfolio companies across the life of a fund. It enables investment teams to understand how assets are performing relative to plan and where attention or intervention is required.

In practice, portfolio monitoring goes beyond periodic financial review. It includes maintaining visibility into operating performance, governance milestones, capital structure, and evolving risks across multiple companies at once. As portfolios grow and funds mature, effective monitoring becomes essential for prioritization and consistency across the firm.

Let's evaluate the purpose, components, and practical execution of portfolio monitoring in private equity environments.

Why is Portfolio Monitoring Important in Private Equity?

Portfolio monitoring is critical because private equity value creation depends on early visibility into performance, risk, and execution gaps across multiple assets. Without consistent monitoring, issues surface late, limiting the ability to intervene meaningfully.

Early risk and performance visibility

Portfolio monitoring allows investment teams to detect underperformance, operational risks, or governance gaps before they become structural problems. Early visibility creates optionality, which is critical in private equity, where corrective actions take time to compound.

Clear prioritization across the portfolio

With multiple portfolio companies competing for attention, monitoring creates a clear signal for prioritization. It helps partners and operating teams focus effort where intervention can materially influence outcomes, rather than reacting to noise.

Consistent evaluation and communication

Standardized portfolio monitoring reduces dependence on informal updates and individual judgment. It creates a shared baseline for evaluating performance, aligning internal decision-making and external communication with LPs.

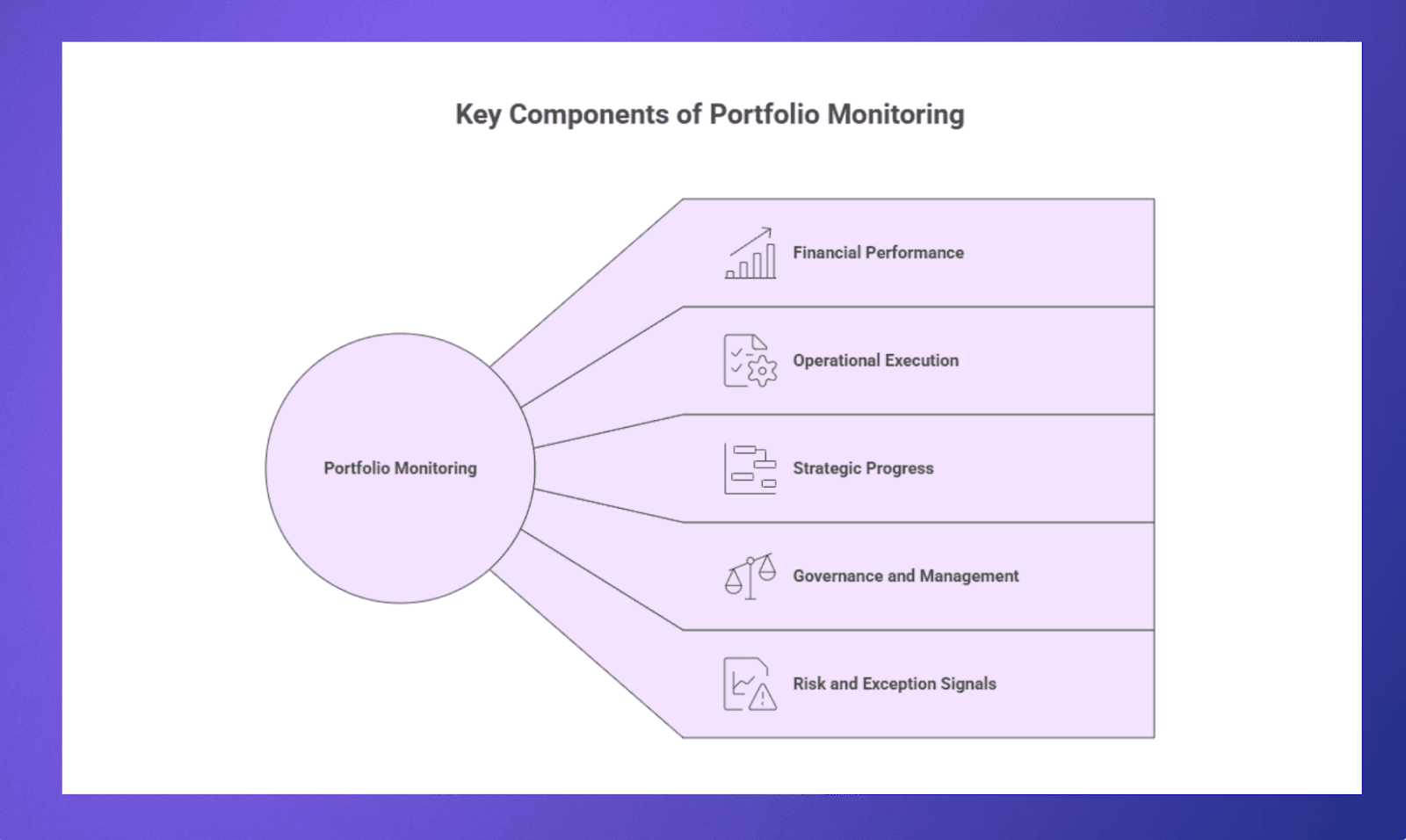

What Investment Teams Monitor in a Private Equity Portfolio? - Key Components

Portfolio monitoring focuses on a defined set of signals that indicate performance, risk, and execution quality. These components give teams a consistent way to assess progress across companies without relying on ad hoc updates.

Financial performance

Teams track revenue growth, profitability, cash flow, and balance sheet health against budget and prior periods. This forms the baseline for understanding whether a company is performing in line with the investment thesis.

Operational execution

Operational metrics reflect how effectively the business is being run. This includes progress on key initiatives, efficiency improvements, hiring plans, and execution against value-creation priorities.

Strategic progress

Monitoring strategic progress helps teams assess whether the company is moving toward its long-term objectives. This may include market expansion, product development, acquisitions, or changes in positioning.

Governance and management

Investment teams monitor board activity, management stability, and decision-making cadence. Strong governance and leadership alignment are critical indicators of a company’s ability to execute over time.

Risk and exception signals

Risk monitoring focuses on identifying deviations from plan, emerging external threats, or internal issues that require attention. Exception-based signals help teams intervene early rather than react late.

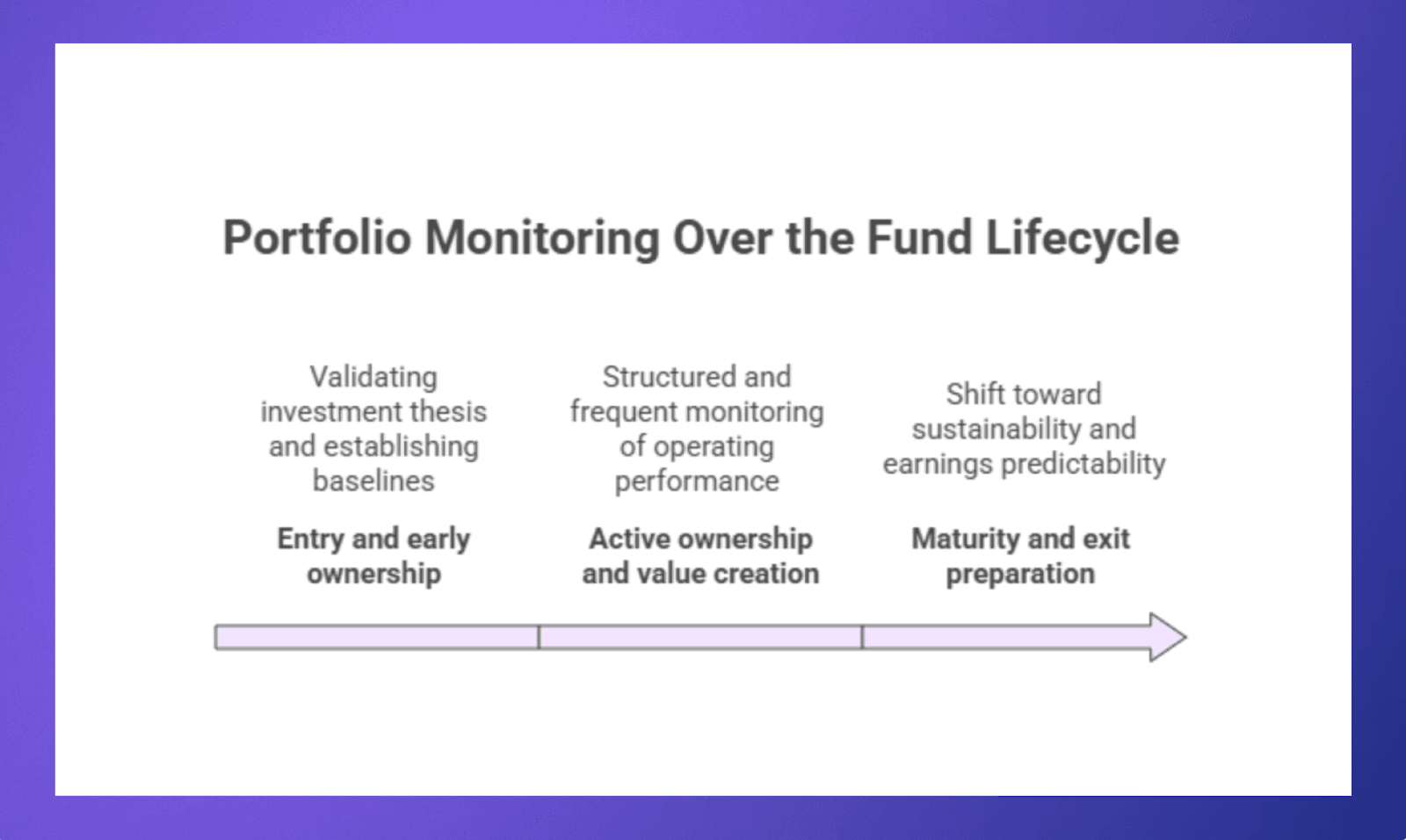

How Portfolio Monitoring Works Over the Fund Lifecycle?

Portfolio monitoring changes as a fund moves from deployment to exit. The focus, cadence, and depth of monitoring evolve with each stage of ownership.

Entry and early ownership

Monitoring centers on validating the investment thesis and establishing baselines. Teams focus on initial performance trends, management alignment, and early execution against the value-creation plan.

Active ownership and value creation

During the core holding period, monitoring becomes more structured and frequent. Investment teams track operating performance, initiative progress, and emerging risks to guide intervention and resource allocation.

Maturity and exit preparation

As companies approach exit, monitoring shifts toward sustainability and predictability. Emphasis is placed on earnings quality, governance discipline, and risk mitigation to support transaction readiness and valuation outcomes.

Common Challenges in Portfolio Monitoring

As portfolios grow in size and complexity, maintaining effective monitoring becomes increasingly difficult. Many challenges emerge not from a lack of effort, but from processes and tools that were not designed to scale across multiple companies and fund stages.

Fragmented information across systems

Portfolio data often lives in spreadsheets, emails, reporting decks, and point tools. This fragmentation makes it difficult to maintain a consistent, up-to-date view across all portfolio companies.

Inconsistent data quality and definitions

Metrics are not always defined or reported consistently across companies. Differences in timing, format, or assumptions reduce comparability and increase interpretation risk.

Delayed visibility into emerging issues

Monitoring processes that rely on periodic reporting can surface problems too late. By the time underperformance is visible, options for intervention may already be limited.

Overreliance on manual processes

Manual data collection and consolidation consume time and introduce errors. This limits how frequently teams can review portfolio performance and reduces confidence in the outputs.

Difficulty scaling as portfolios grow

As funds add more companies and strategies, informal monitoring approaches break down. Without structure, teams struggle to maintain depth and consistency across the portfolio.

How Portfolio Monitoring Supports Investment Decisions?

Portfolio monitoring supports investment decisions by creating a continuous feedback loop between performance data and action. Instead of reacting to isolated updates, teams use monitoring to guide judgment across capital deployment, operational involvement, and portfolio-level tradeoffs.

Informs timely intervention and strategic adjustments

Portfolio monitoring turns ongoing performance signals into actionable insight, helping teams decide when to intervene, when to stay the course, and when to adjust strategy.

Supports capital allocation and operational decisions

At the deal level, monitoring informs decisions around follow-on investments, leadership changes, and operational support. At the portfolio level, it helps balance risk and sequence exits more effectively.Improves decision quality over time through historical context

Consistent monitoring preserves institutional knowledge, allowing teams to identify patterns across companies and funds and apply those lessons to future investment decisions.

Over time, this decision support compounds. Firms that monitor consistently develop clearer pattern recognition, stronger prioritization, and more repeatable outcomes across funds, rather than relying on instinct or fragmented information.

How Portfolio Monitoring Differs From Reporting?

Portfolio monitoring and reporting are closely related but serve distinct purposes inside a private equity firm. Monitoring is an ongoing management discipline used to guide decisions, while reporting is a structured output designed to communicate outcomes to stakeholders.

Aspect | Portfolio Monitoring | Reporting |

Timing | Continuous and ongoing throughout the quarter | Periodic and tied to fixed reporting cycles |

Primary Purpose | Support decision-making and prioritization | Communicate performance and updates |

Audience | Support decision-making and prioritization | LPs, advisory committees, internal records |

Scope | Portfolio-wide view across multiple companies | Often focused on individual companies |

Orientation | Forward-looking and action-oriented | Backward-looking and summary-oriented |

Context | Forward-looking and action-oriented | Emphasizes clarity and consistency of presentation |

Recognizing the difference between monitoring and reporting helps teams avoid using static reports as a substitute for active oversight. Effective portfolio management relies on monitoring to drive action, with reporting serving as a complementary output rather than the decision engine itself.

Who is Responsible for Portfolio Monitoring Inside a Firm?

Portfolio monitoring is a shared responsibility, with accountability distributed across roles to ensure both depth and consistency. Clear ownership prevents gaps between data collection, interpretation, and action.

Deal partners - Own overall performance oversight for their investments, using monitoring signals to guide intervention, governance decisions, and strategic direction.

Operating partners and portfolio teams - Support execution by tracking operational progress, identifying risks, and working with management teams on value-creation initiatives.

Investment professionals - Maintain day-to-day visibility into metrics, prepare analyses, and surface exceptions that require senior attention.

Firm leadership - Uses portfolio-level monitoring to assess risk concentration, resource allocation, and pacing across the fund.

When responsibilities are clearly defined, portfolio monitoring becomes a coordinated process rather than a collection of disconnected updates.

Tools Used for Portfolio Monitoring Today

Portfolio monitoring typically relies on a combination of systems, each addressing a different part of the workflow. Most firms use multiple tools rather than a single, unified solution.

Spreadsheets and internal models

Common for tracking financial performance and forecasts, but difficult to scale and maintain consistently across multiple portfolio companies.

Reporting and BI tools

Used to visualize performance and trends once data is consolidated. These tools are effective for analysis but depend heavily on upstream data quality and manual inputs.

Portfolio company reporting packs

Management teams provide regular updates through standardized decks or templates. These are useful for structured communication but often lag real-time developments.

CRM and relationship tools

Employed to track interactions, governance touchpoints, and stakeholder communication. These tools are rarely designed to connect relationship context directly to portfolio performance.

Because these tools are often disconnected, investment teams spend significant time reconciling information and preserving context manually. This fragmentation is a primary driver behind the push for more integrated portfolio monitoring approaches.

Modern Portfolio Monitoring With Rings AI

Traditional portfolio monitoring breaks down when context is scattered across tools, updates live in silos, and historical decisions are hard to reconstruct. As portfolios grow, teams spend more time assembling information than acting on it.

Rings AI approaches portfolio monitoring as a system of continuity. It connects portfolio companies, deals, relationships, and historical context in one place, giving investment teams a clear, evolving view of performance and risk across the fund. Monitoring is no longer a series of static snapshots, but a living record that supports better judgment over time.

By preserving context across companies, cycles, and team changes, Rings AI helps firms move from reactive oversight to intentional portfolio management. Decisions are grounded in shared understanding rather than fragmented updates.

Book a demo to see how modern portfolio monitoring works in practice.